Correct Answer

verified

Correct Answer

verified

Essay

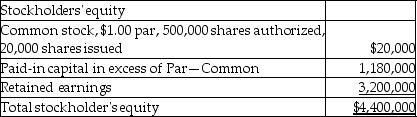

On July 31, 2015, the Archer Company reported the following information in the equity section of their balance sheet:  Assume that Archer carries out a 3-for-1 stock split. Please prepare a similar equity section showing the effects of the stock split. (Please round all numbers to the nearest cent.)

Assume that Archer carries out a 3-for-1 stock split. Please prepare a similar equity section showing the effects of the stock split. (Please round all numbers to the nearest cent.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Occidental Produce Company has 40,000 shares of common stock outstanding and 2,000 shares of preferred stock outstanding. The common stock is $0.01 par value; the preferred stock is 4% noncumulative, with $100 par value. On October 15, 2015, the company declares a total dividend payment of $40,000. How much dividend will be paid to the preferred shareholders?

A) $40,000

B) $2,000

C) $8,000

D) $4,500

Correct Answer

verified

Correct Answer

verified

True/False

Retained earnings represents amounts received from stockholders of a corporation in exchange for stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation originally issued $5 par value common stock for $6 per share. Which of the following would be included in the entry to record the purchase of 300 shares of treasury stock for $10 per share?

A) Treasury Stock-Common would be debited for $3,000.

B) Treasury Stock-Common would be credited for $1,800.

C) Retained Earnings would be debited for $1,500.

D) Treasury Stock-Common would be debited for $1,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From its inception through the year of 2014, Quicksales Company was profitable and made strong dividend payments each year. In the year 2015, Quicksales had major losses and paid no dividends. In 2016, the company started making large profits again, and they were able to pay dividends to all shareholders-both common and preferred. There are 1,500 shares of cumulative, 7% preferred stock outstanding. The preferred stock has a par value of $100. What is the total amount of dividends that should be paid to the preferred shareholders in December, 2016?

A) $33,500

B) $22,000

C) $10,500

D) $21,000

Correct Answer

verified

Correct Answer

verified

True/False

A corporation is a separate legal entity and is organized independently of its owners.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 15,000 shares of 10%, $50 par cumulative preferred stock outstanding and 25,000 shares of no-par common stock outstanding. Dividends of $37,500 are in arrears. At the end of the current year, the corporation declares a dividend of $120,000. How is the dividend allocated between preferred and common shareholders?

A) The dividend is allocated $7,500 to preferred shareholders and $112,500 to common shareholders.

B) The dividend is allocated $112,500 to preferred shareholders and $7,500 to common shareholders.

C) The dividend is allocated $120,000 to preferred shareholders and no dividend is paid to common shareholders.

D) The dividend is allocated $75,000 to preferred shareholders and $45,000 to common shareholders.

Correct Answer

verified

Correct Answer

verified

True/False

Stock dividends are distributed to stockholders in proportion to the number of shares each stockholder already owns.

Correct Answer

verified

Correct Answer

verified

True/False

The statement of retained earnings reports how the company's retained earnings balance changed from the beginning of the period to the end of the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

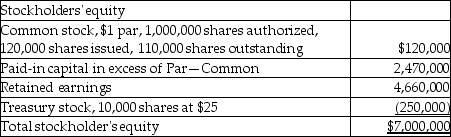

On March 31, 2015, the Park Place Company shows the following data on their balance sheet:  Assume that Park Place sells 900 shares of treasury stock at $32 per share. What will the total stockholders' equity be after this transaction?

Assume that Park Place sells 900 shares of treasury stock at $32 per share. What will the total stockholders' equity be after this transaction?

A) $7,751,200

B) $7,028,800

C) $7,080,900

D) $7,030,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

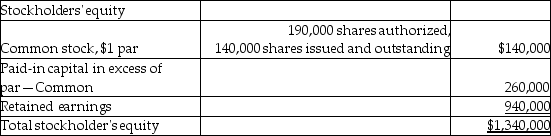

On June 30, 2015, Roger Company showed the following data on the equity section of their balance sheet:  On July 1, 2015, Roger declared and distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would the new balance in Retained Earnings be?

On July 1, 2015, Roger declared and distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would the new balance in Retained Earnings be?

A) $916,000

B) $942,000

C) $966,000

D) $849,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of the distribution of stock dividends?

A) It decreases both assets and liabilities.

B) It decreases assets and increase liabilities.

C) It affects only stockholder's equity accounts.

D) It increases both dividends payable and cash.

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a stock dividend creates a liability for the corporation.

Correct Answer

verified

Correct Answer

verified

True/False

Stated value stock is no-par stock that has been assigned an amount similar to par value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following corporate characteristics is a disadvantage of a corporation?

A) Stockholders of a corporation have limited liability.

B) A corporation has a continuous life.

C) There is no mutual agency among the stockholders and the corporation.

D) Earnings of a corporation are taxed twice.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 15,000 shares of 10%, $50 par cumulative preferred stock outstanding and 25,000 shares of no-par common stock outstanding. Dividends of $37,500 are in arrears. At the end of the current year, the corporation declares a dividend of $120,000. What is the dividend per share for preferred shares and for common shares?

A) The dividend per share is $5.00 to preferred shares and $4.60 per share to common shares.

B) The dividend per share is $8.00 to preferred shares and $0 per share to common shares.

C) The dividend per share is $7.50 to preferred shares and $0.30 per share to common shares.

D) The dividend per share is $8.00 to preferred shares and $0.30 per share to common shares.

Correct Answer

verified

Correct Answer

verified

Essay

On December 2, 2014, Ewell Company purchases a piece of land from the original owner. In exchange for the land, Ewell Company issues 8,000 shares of common stock with $1.00 par value. The land has been appraised at a market value of $400,000. Provide the journal entry for this transaction.

Correct Answer

verified

Correct Answer

verified

True/False

When a company has issued both preferred and common stock, the common stockholders are allocated their dividends first.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

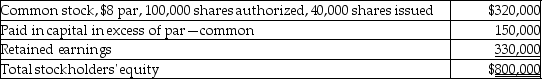

Gordon Corporation reported the following equity section on its current balance sheet. The common stock is currently selling for $11.50 per share.  What would be the balance in the Common Stock account after the issuance of a 10% stock dividend?

What would be the balance in the Common Stock account after the issuance of a 10% stock dividend?

A) $300,000

B) $288,000

C) $352,000

D) $320,000

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 158

Related Exams