A) A, B, C

B) C, B, A

C) B, A, C

D) B, C, A

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is used as the equation's numerator when computing the accounting rate of return for a capital asset?

A) Average amount invested in the asset

B) Average annual operating income from the asset

C) Total amount invested in the asset

D) Average net cash flows from the asset

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a capital asset?

A) The item will be used for a long period of time.

B) The item involves a significant sum of money.

C) None of these characteristics are correct.

D) Both A and B are correct.

Correct Answer

verified

Correct Answer

verified

True/False

Choosing among alternative capital investments is called a post-audit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

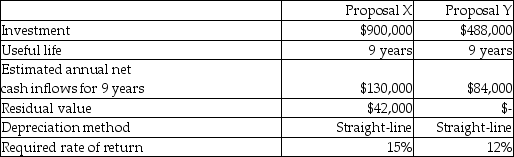

Redwood Corporation is considering two alternative investment proposals with the following data:  What is the accounting rate of return for Proposal Y? (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, X.XX%.)

What is the accounting rate of return for Proposal Y? (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, X.XX%.)

A) 11.11%

B) 6) 10%

C) 4) 06%

D) 17.21%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compound interest means that interest is calculated on

A) the installment of an annuity.

B) only interest earned to date.

C) principal only.

D) principal AND all interest earned to date.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your hard work in college paid off, quite literally, and you received a graduate assistantship for your MBA program. The assistantship pays a stipend of $12,000 at the end of each of the next 2 years. Using an average discount rate of 2%, the future value of your assistantship can be calculated by

A) PV = $12,000 × 2% × 2.

B) PV = $12,000 (PV factor, i = 2%, n = 2) .

C) PV = $12,000 (Annuity PV factor, i = 2%, n = 2) .

D) PV = $12,000 (Annuity FV factor, i = 2%, n = 2) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Siesta Manufacturing has asked you to evaluate a capital investment project. The project will require an initial investment of $54,000. The life of the investment is 6 years with a residual value of $6,000. If the project produces net annual cash inflows of $20,000, what is the accounting rate of return? (Round any intermediary calculations to the nearest dollar and your final answer to two decimal places, X.XX%.)

A) 20.37%

B) 22.22%

C) 2) 70%

D) 37.04%

Correct Answer

verified

Correct Answer

verified

Short Answer

The Toth Company bought a new specialty machine that cost $100,000 with a 4-year life with no residual value. The company plans to generate annual cash inflows of $30,000 each year for 4 years. Calculate the accounting rate of return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manager wants to know which investment decision will affect the bottom line of the financial statements according to Generally Accepted Accounting Principles. Which capital budgeting method would he choose?

A) Payback method

B) Accounting rate of return method

C) Net present value method

D) Profitability index

Correct Answer

verified

Correct Answer

verified

True/False

Post-audits of capital investments compare actual net cash inflows to projected net cash inflows.

Correct Answer

verified

Correct Answer

verified

True/False

The costs to develop a major website for a company would be considered to be a capital asset if those costs are significant and material (for example, the costs to develop the website exceed $100,000).

Correct Answer

verified

Correct Answer

verified

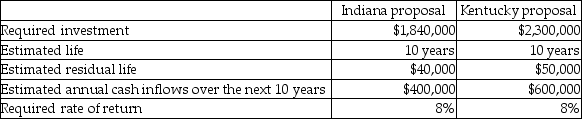

Multiple Choice

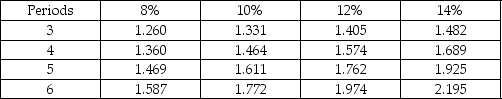

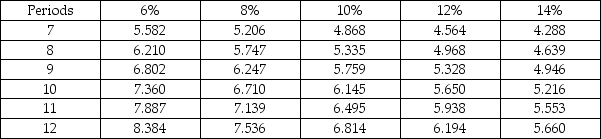

If you invest $1,600 at the end of every year for four years at an interest rate of 14%, the balance of your investment in 4 years will be closest to: Future Value of $1

Future Value of Annuity of $1

Future Value of Annuity of $1

A) $2702.

B) $6400.

C) $7874.

D) $4662.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of choosing among different alternative investments due to limited resources is referred to as

A) capital investing.

B) capital rationing.

C) resource rationing.

D) resource allocation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

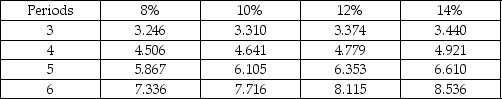

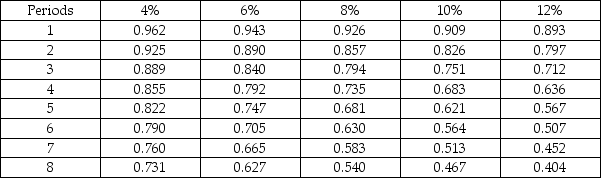

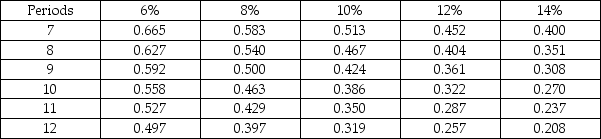

Dandy's Fun Park is evaluating the purchase of a new game to be located on its Midway. Dandy's has narrowed their choices down to two: the Wacky Water Race game and the Whack-A-Mole game. Financial data about the two choices follows.  What is the total present value of future cash inflows and residual value from the Whack-A-Mole game?

Present Value of $1

What is the total present value of future cash inflows and residual value from the Whack-A-Mole game?

Present Value of $1

Present Value of Annuity of $1

Present Value of Annuity of $1

A) $11,373

B) $8268

C) $14,478

D) $41,478

Correct Answer

verified

Correct Answer

verified

Multiple Choice

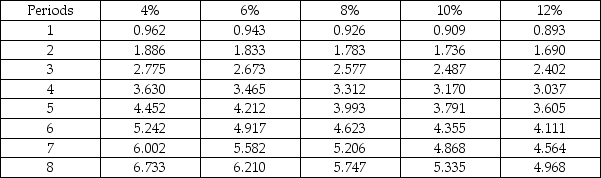

The Silverside Company is considering investing in two alternative projects:  What is the payback period for Project 2?

What is the payback period for Project 2?

A) 1) 54 years

B) 3) 69 years

C) 12.00 years

D) 10.00 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

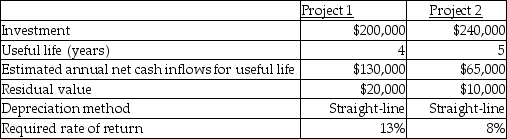

O'Mally Department Stores is considering two possible expansion plans. One proposal involves opening 5 stores in Indiana at the cost of $1,840,000. Under the other proposal, the company would focus on Kentucky and open 6 stores at a cost of $2,300,000. The following information is available:  The net present value of the Indiana proposal is closest to:

Present Value of $1

The net present value of the Indiana proposal is closest to:

Present Value of $1

Present Value of Annuity of $1

Present Value of Annuity of $1

A) $844,000.

B) $862,520.

C) $825,480.

D) $2,702,520.

Correct Answer

verified

Correct Answer

verified

True/False

The payback method can be used when the net cash inflows from a capital investment are unequal.

Correct Answer

verified

Correct Answer

verified

True/False

Capital budgeting is done when common stock is issued.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula for calculating the accounting rate of return for a capital asset is

A) average annual operating income from asset/amount invested in asset.

B) average annual net cash inflow from asset/amount invested in asset.

C) (average annual operating income + depreciation expense) /amount invested in asset.

D) (average annual cash inflows - depreciation expense) /(amount invested in asset + residual value of asset) .

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 213

Related Exams