A) take actions to reduce chartered bank reserves.

B) take actions to increase chartered bank reserves.

C) ask the chartered banks to lower the desired reserve ratio.

D) do none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A consumer holds money to meet spending needs.This would be an example of the:

A) use of money as a measure of value.

B) use of money as legal tender.

C) transactions demand for money.

D) asset demand for money.

Correct Answer

verified

Correct Answer

verified

True/False

Bond prices and interest rates are directly related.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

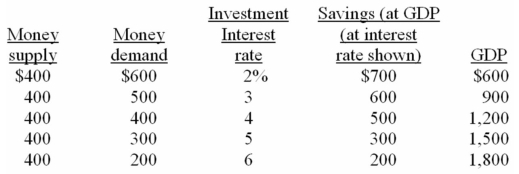

Assume that the desired reserve ratio is 10 percent and there are no excess reserves in the banking system.Also,suppose that the full-employment,non-inflationary level of GDP in this closed,private economy is $1,200.

-Refer to the above information.An interest rate of 2 percent is not sustainable because:

-Refer to the above information.An interest rate of 2 percent is not sustainable because:

A) the demand for bonds in the bond market will fall and the interest rate will fall.

B) the demand for bonds in the bond market will rise and the interest rate will fall.

C) the supply of bonds in the bond market will decline and the interest rate will rise.

D) the supply of bonds in the bond market will rise and the interest rate will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years,the Bank of Canada has adopted a monetary policy that focuses on:

A) the money supply as the policy target.

B) overnight lending rate as the policy target.

C) net exports as the policy target.

D) the prime interest rate as a policy target.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a bond with no expiration date is originally $5,000 and it pays an annual interest payment of $500.If the price of the bond falls to $3,000,then the effective interest rate yield to a new buyer of the bond is:

A) 14.4 percent.

B) 16.6 percent.

C) 11.0 percent.

D) 9.0 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The bank rate is the rate of interest at which:

A) the Bank of Canada lends to chartered banks.

B) financial institutions lend to some builders.

C) the Bank of Canada lends to large corporations.

D) chartered banks lend to large corporations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase the overnight lending rate,the Bank of Canada can:

A) buy government bonds from the public.

B) decrease the bank rate.

C) decrease the prime interest rate.

D) sell government bonds to chartered banks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of an expansionary monetary policy is to:

A) increase aggregate demand.

B) decrease aggregate demand.

C) increase investment demand.

D) decrease investment demand.

Correct Answer

verified

Correct Answer

verified

True/False

The Bank of Canada can use three instruments--Open-market operations,tax collection,and bank rate-to influence the chartered banks' reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Bank of Canada buys government securities from the chartered banks,which of the following transactions take place?

A) The demand deposits of chartered banks are unchanged,but their reserves increase.

B) The demand deposits and reserves of chartered banks both decrease.

C) The demand deposits of chartered banks are unchanged,but their reserves decrease.

D) The demand deposits and reserves of chartered banks are both unchanged.

Correct Answer

verified

Correct Answer

verified

True/False

Other things equal,an expansionary monetary policy will shift the economy's aggregate demand curve to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) A restrictive monetary policy will cause the dollar to appreciate and Canadian net exports to increase.

B) A restrictive monetary policy will cause the dollar to appreciate and Canadian net exports to decrease.

C) A restrictive monetary policy will cause the dollar to depreciate and Canadian net exports to increase.

D) A restrictive monetary policy will cause the dollar to depreciate and Canadian net exports to decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If during a certain period the Bank of Canada's policy target was to stabilize the money supply,we would expect:

A) less inflation than if the Bank of Canada's policy was to stabilize interest rates.

B) tax revenues to fall.

C) interest rates to be quite volatile.

D) interest rates to be unusually stable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an expansionary monetary policy?

A) Increase the money supply to shift the aggregate demand curve rightward.

B) Increase the money supply to shift the aggregate demand curve leftward.

C) Increase the money supply to shift the aggregate supply curve leftward.

D) Decrease the money supply to shift the aggregate demand curve leftward.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

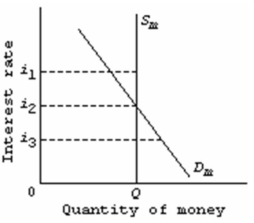

Refer to the market for money diagram below.The downward slope of the money demand curve Dm can best be explained in terms of the:

A) transactions demand for money.

B) direct or positive relationship between bond prices and interest rates.

C) asset demand for money.

D) wealth or real-balances effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Special Purchase and Resale Agreement (SPRA) ,is a transaction in which:

A) the Bank of Canada,offers to sell government securities with an agreement to buy them back at a predetermined price the next business day.

B) the Bank of Canada,offers to buy government securities with an agreement to sell them back at a predetermined price the next business day.

C) the Bank of Canada,offers to buy government securities with an agreement to sell them back at a predetermined price the next month.

D) the Bank of Canada,offers to sell government securities with an agreement to buy them back at a predetermined price the next month.

Correct Answer

verified

Correct Answer

verified

True/False

An expansionary monetary policy may be more effective than a restrictive monetary policy because chartered banks may decide to hold a large quantity of excess reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) Bond prices and the interest rate are inversely related.

B) A lower interest rate raises the opportunity cost of holding money.

C) The supply of money is directly related to the interest rate.

D) The total demand for money is directly related to the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

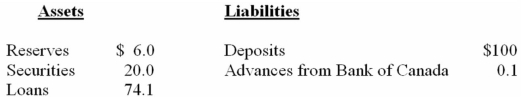

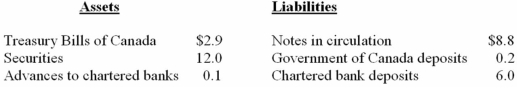

The following is a simplified consolidated balance sheet for the chartered banking system and the Bank of Canada.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.

CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM

BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA

-Assume the desired reserve ratio is 25 percent and the Winnipeg Bank borrows $10,000 from the Bank of Canada.As a result:

-Assume the desired reserve ratio is 25 percent and the Winnipeg Bank borrows $10,000 from the Bank of Canada.As a result:

A) chartered bank reserves are increased by $10,000.

B) the supply of money automatically declines by $7,500.

C) chartered bank reserves are increased by $7,500.

D) the supply of money is automatically increased by $10,000.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 238

Related Exams