Departments are the cost objects when the plantwide overhead rate method is used.

B) False

Correct Answer

verified

Correct Answer

verified

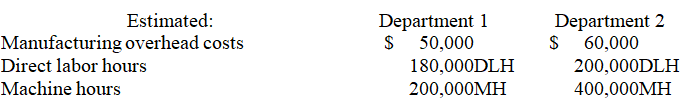

The following data relates to Patterson Company's estimated amounts for next year.  What is the company's plantwide overhead rate if direct labor hours are the allocation base?

What is the company's plantwide overhead rate if direct labor hours are the allocation base?

A) $3.45 per DLH

B) $5.45 per DLH

C) $0.29 per DLH

D) $0.26 per DLH

E) $0.20 per DLH

G) D) and E)

Correct Answer

verified

Correct Answer

verified