A) $16,500

B) $12,000

C) $4,500

D) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Production and inventory budgets form the basis for developing the revenue budget.

Correct Answer

verified

Correct Answer

verified

True/False

In a production budget, beginning inventory plus budgeted production equals sales plus targeted ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ATR's budgeted product costs for the third quarter of 2010 were based on an expected volume of 1,500 units. The budgeted unit costs appear below: If ATR had a budgeted volume of 2,000 units, the total budgeted product cost for the third quarter of 2010 would have been

A) $22,000

B) $16,000

C) $20,500

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Intentionally understating revenues and / or overstating costs during a budgeting process is called

A) Budgetary slack

B) Zero-based budgeting

C) Fraudulent financial reporting

D) Participative budgeting

Correct Answer

verified

Correct Answer

verified

True/False

To prepare a budgeted income statement, managers draw data from the revenue budget, the cost of goods sold budget, and the cash budget.

Correct Answer

verified

Correct Answer

verified

True/False

A master budget is a comprehensive plan for an upcoming financial period.

Correct Answer

verified

Correct Answer

verified

True/False

Managers often use short-term loans or prearranged lines of credit to balance the cash budget.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

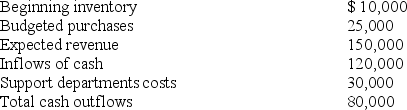

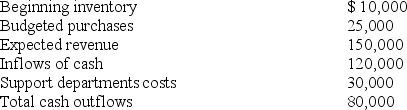

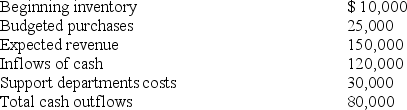

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  Which of the following amounts will be subtracted from gross profit on TFS' budgeted income statement?

Which of the following amounts will be subtracted from gross profit on TFS' budgeted income statement?

A) $30,000

B) $80,000

C) $14,000

D) $110,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted gross profit for the next fiscal year will be

TFS' budgeted gross profit for the next fiscal year will be

A) $136,000

B) $106,000

C) $125,000

D) $122,000

Correct Answer

verified

Correct Answer

verified

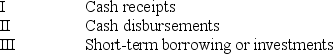

Multiple Choice

To prepare a cash budget, managers plan

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Phillips Company's budgeted annual indirect labor cost is: $7,200 + $0.75 per direct labor hour. Operating budgets for the current month are based on 30,000 hours of budgeted direct labor hours. Budgeted indirect labor cost is

A) $22,500

B) $29,700

C) $22,000

D) $23,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted profit before taxes for the next financial year will be

TFS' budgeted profit before taxes for the next financial year will be

A) $106,000

B) $40,000

C) $66,000

D) $92,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget that reflects a range of operations is called a

A) Standard budget

B) Activity-based budget

C) Flexible budget

D) Benchmark budget

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The actual preparation of a budget usually begins with the

A) Production budget

B) Cash budget

C) Sales budget

D) Direct materials budget

Correct Answer

verified

Correct Answer

verified

True/False

Budgeting provides a means for defining managers' decision rights (responsibility and financial decision making authority).

Correct Answer

verified

Correct Answer

verified

True/False

An operating budget is the component of a master budget that contains management's plans for revenues, production, and operating costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelita Ltd, projects sales for its first three months of operation as follows: Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale. What are the anticipated cash receipts for October?

A) $-0-

B) $40,000

C) $47,500

D) $66,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a budgeted income statement, the gross margin is determined by

A) Revenue + cost of goods sold

B) Cost of goods sold + operating costs

C) Revenue - operating costs

D) Revenue - cost of goods sold

Correct Answer

verified

Correct Answer

verified

True/False

Cost-volume-profit analysis is a simplified version of a flexible budget.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 87

Related Exams