A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Match each statement with the correct term below. -Ordinary Expense

A) Specifically disallowed.

B) Appropriate and helpful.

C) Considered a trade or business.

D) Not considered a trade or business.

E) Problems with this generally arise with related parties.

F) This is met when services or property are provided to the taxpayer.

G) Normal,common,and accepted but not necessarily regularly recurring.

H) This is met when the existence and the amount of a liability have been established.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The legislative grace concept dictates that deductible business expenses be grouped into certain categories that include I.Personal expenses. II.Trade or business expenses. III.Expenses for the production of income.

A) Statements I and II are correct.

B) Statements I and III are correct.

C) Statements I,II,and III are correct.

D) Statements II and III is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expenses is/are deductible? I.Transportation and lodging expenses of $3,000 incurred to monitor state legislation that may affect the taxpayer's business. II.Lobby expenses of $300 during the year to influence local town legislators to support pro-business legislation.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Landis is a single taxpayer with an adjusted gross income of $280,000.In addition to his personal residence,Landis owns a vacation home in Beaver Creek,Colorado.He uses the vacation home for 21 days during the current year and rents it out to unrelated parties for 63 days.After making the appropriate allocation between rental and personal use,the following rental loss is determined:

What is the correct reporting of the rental income and expenses?

I.Because the rental shows a loss,Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction.

II.Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses.

III.Landis's depreciation deduction is limited to $4,800.

IV.Because the vacation home is a qualified second residence,Landis can deduct the $1,600 loss for adjusted gross income.

What is the correct reporting of the rental income and expenses?

I.Because the rental shows a loss,Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction.

II.Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses.

III.Landis's depreciation deduction is limited to $4,800.

IV.Because the vacation home is a qualified second residence,Landis can deduct the $1,600 loss for adjusted gross income.

A) Only statement II is correct.

B) Only statement IV is correct.

C) Only statement I is correct.

D) Statements II and III are correct.

E) Statements II and IV are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

James rents his vacation home for 30 days during the year and lives in it personally for 10 days.He receives rents of $4,000 and incurs the following expenses before allocation:

What is James' income or loss from the rental property?

What is James' income or loss from the rental property?

A) $- 0 -

B) $1,000 loss

C) $1,250 loss

D) $1,000 income

E) $1,200 income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shaheen owns 2 rental properties.She hires her 21 year old son,who is a junior at State College,to obtain tenants,negotiate leases,make arrangements for repairs,and pay expenses related to the properties. I.Shaheen's sale of the properties will result in a capital gain or loss. II.Shaheen's sale of the properties at a loss results in a current-year loss deduction of no more than $3,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following independent situations is the taxpayer entitled to deduct expenses related to the home office? I.A real estate agent employed by a local real estate agency owns several rental properties.She regularly and exclusively uses a second bedroom in her home solely as an office for bookkeeping and other activities related to management of the rental properties.She has no other place to perform these functions. II.An attorney employed by a large law firm frequently brings work home from the office.She uses a study in her home for doing this work as well as managing her investment portfolio.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul owns a lumber yard in Portland.He has decided to expand his business interests and is considering opening a golf course in Seattle.He has incurred $51,000 of expenses investigating whether to open the new golf course.In January of the current year he finds the perfect location and opens the golf course on July 1.What amount of the investigation expenses can he deduct in the current year?

A) $- 0 -

B) $5,100

C) $5,567

D) $6,533

E) $51,000

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Portia,a CPA,operates a financial and tax planning service.During the months of February,March,and April of every year,she hires graduate tax students from The University of Chicago as interns.This year she hires 4 interns.One is her brother,Sidney.She pays all interns except Sidney $20 per hour for help with tax return preparation and tax research.Sidney receives $25 an hour.She cannot deduct the full amount of Sidney's hourly wages because the expense is not

A) appropriate.

B) ordinary.

C) necessary.

D) reasonable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

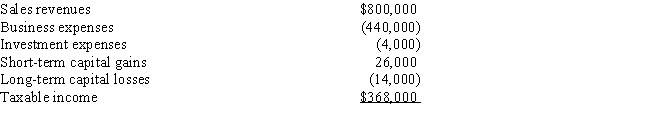

Tom,Dick,and Harry operate Quality Stores.Based on advice from Tom's sister,a CPA,the three form a partnership.Tom owns 50%;Dick and Harry each own 25%.For the year,Quality Stores reports the following:

By how much will Tom's adjusted gross income increase because of the above?

By how much will Tom's adjusted gross income increase because of the above?

A) $178,000

B) $180,000

C) $183,000

D) $184,000

E) $186,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mario paints landscape portraits,and he treats the activity as a hobby.During the current year,Mario incurred the following expenses while earning $2,500 from sales of paintings:

Mario uses the standard deduction and never itemizes his deductions.How should Mario report all of the items related to his hobby on his tax return?

Mario uses the standard deduction and never itemizes his deductions.How should Mario report all of the items related to his hobby on his tax return?

A) Hobby losses are not allowed so he couldn't deduct anything whether or not he itemizes anyway.

B) Report a $400 loss as a deduction for AGI.

C) Include $2,500 in gross income and deduct $2,500 for AGI.

D) Include $2,500 in gross income and deduct nothing for AGI.

E) Include $2,500 in gross income and deduct $1,700 for studio expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is/are trade or business expenses? I.Solly incurs legal expenses related to real estate he leases to Bucko Burger Hamburger Haven for a parking lot.Solly does little but negotiate the lease every year.. II.Susan owns several rental apartments.She negotiates new rental contracts,arranges for repairs and maintenance,and handles all leasing activities.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Electronic City sells various electronic products.With each of its products,Electronic City offers customers the option of purchasing a repair contract.Under the contracts,Electronic City will make repairs anytime during the term of the contract.Electronic City estimates that repair costs related to this year's sales will be $39,000.During the current year,Electronic City incurs repair costs of $37,000 related to prior year's contracts and $4,000 on contracts sold this year. I.If Electronic City accounts for the contracts using the accrual method of accounting,its repair cost deduction is $39,000. II.If Electronic City accounts for the contracts using the cash method of accounting,its repair cost deduction is $41,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following is a currently deductible trade or business expense.

A) $ 5,000 trustee fees paid to a bank to manage tax-exempt securities.

B) $ 12,000 fee paid to a marketing firm for a market analysis for a new business.

C) $15,000 fee paid to a TV station to advertise a new product.

D) $20,000 to an attorney to defend title to a new patent.

E) All of the above are currently deductible expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income tax accounting methods and financial accounting methods differ in many ways.Which of the following tax law provisions are likely to create permanent differences between taxable income and financial (or book) income of an entity? I.The cost of certain property is allowed to be deducted in the year of acquisition rather than through regular depreciation methods. II.Tax depreciation is computed over a statutory life rather than the asset's useful life.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charlotte traveled to Annapolis to attend a three-day business conference.After her meetings concluded,she stays 2 additional days sightseeing.Charlotte's airfare is $400 and pays $110 per night for lodging,$60 a day for meals,and $20 a day for incidentals.How much of Charlotte's costs can be deducted as a business expense?

A) $- 0 -

B) $400

C) $880

D) $970

E) $1,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Girardo owns a condominium in Key West.During the year,Girardo uses the condo a total of 22 days.The condo is also rented to vacationers for a total of 78 days and generates rental income of $24,000.Girardo incurs the following expenses before allocation:

The amount of depreciation that Girardo may deduct with respect to the rental property is

The amount of depreciation that Girardo may deduct with respect to the rental property is

A) $7,300

B) $9,960

C) $14,040

D) $17,160

E) $22,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement with the correct term below. -Reasonable Expense

A) Specifically disallowed.

B) Appropriate and helpful.

C) Considered a trade or business.

D) Not considered a trade or business.

E) Problems with this generally arise with related parties.

F) This is met when services or property are provided to the taxpayer.

G) Normal,common,and accepted but not necessarily regularly recurring.

H) This is met when the existence and the amount of a liability have been established.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The all-events test requires that I.All events have occurred that determine a liability exists II The due date for payment of the liability has been established III.The amount of a liability is determined with reasonable accuracy.

A) Only statement I is correct.

B) Statement I and II are correct.

C) Statement I and III are correct

D) Statements I,II,and III are correct.

E) Only statement III is correct

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 167

Related Exams