A) $730,000

B) $700,000

C) $690,000

D) $645,000

Correct Answer

verified

Correct Answer

verified

True/False

For short-term pricing decisions,fixed costs are usually not relevant because they do not change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

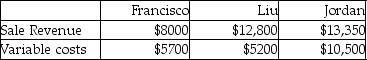

Adventures Company provides event management services.The company has three employees,each assigned to specific customers.The company considers each employee's territory as a business segment.The following data relate to its three segments for the month of June:

The business segments had the following number of customers: Francisco,24 ;Liu,28;and Jordan,33.The total fixed costs for the month of June amount to $3400.Which business segment was the most profitable?

The business segments had the following number of customers: Francisco,24 ;Liu,28;and Jordan,33.The total fixed costs for the month of June amount to $3400.Which business segment was the most profitable?

A) Francisco

B) Liu

C) Jordan

D) Both Francisco and Liu are equally profitable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of the traditional format of the income statement?

A) It is prepared under the variable costing method.

B) It shows contribution margin as a line item.

C) It is not allowed under GAAP.

D) It is prepared under the absorption costing method.

Correct Answer

verified

Correct Answer

verified

True/False

In service companies,variable costing can be used for profitability analysis and contribution margin analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

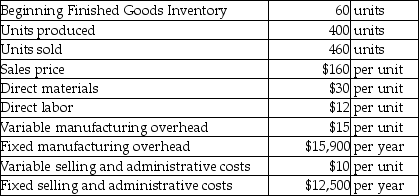

Barrett,Inc.reports the following information for the year ended December 31:

The beginning Finished Goods Inventory costs were $3300 under absorption costing and $3420 under variable costing.

What is the operating income using variable costing?

The beginning Finished Goods Inventory costs were $3300 under absorption costing and $3420 under variable costing.

What is the operating income using variable costing?

A) $42,780

B) $45,200

C) $14,380

D) $4780

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When production is greater than sales,the operating income will be higher under absorption costing than variable costing.Assume zero beginning and ending inventories.Which of the following gives the correct reason for the above statement?

A) All costs incurred have been recorded as expenses.

B) A portion of the fixed manufacturing overhead is still in the ending Finished Goods Inventory account under absorption costing.

C) All selling and administrative expenses have been recorded as period costs.

D) Fixed manufacturing costs have not been considered when calculating the operating profits.

Correct Answer

verified

Correct Answer

verified

True/False

Variable costing can also be used in service companies,especially in making short-term decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When there are no beginning or ending balances in Finished Goods Inventory,variable and absorption costing will result in ________.

A) different amounts for ending Work-in-Process Inventory

B) the same operating income

C) different sales revenue

D) different amounts for cost of goods sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

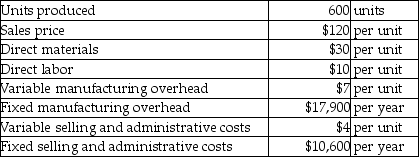

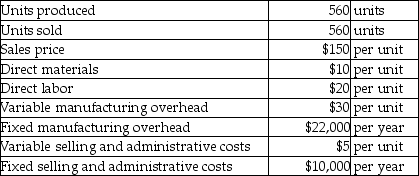

Iagan,Inc.has collected the following data.(There are no beginning inventories. )

What is the ending balance in Finished Goods Inventory using variable costing if 500 units are sold?

What is the ending balance in Finished Goods Inventory using variable costing if 500 units are sold?

A) $4000

B) $4700

C) $1700

D) $3000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

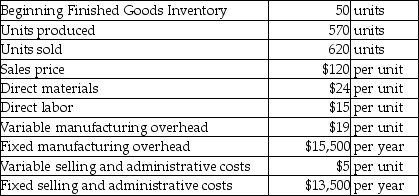

McIntosh,Inc.reports the following information:

What is the unit product cost using variable costing? (Round your answer to the nearest cent. )

What is the unit product cost using variable costing? (Round your answer to the nearest cent. )

A) $85.19

B) $58.00

C) $61.19

D) $113.88

Correct Answer

verified

Correct Answer

verified

True/False

The fixed manufacturing overhead is considered a product cost in variable costing and a period cost in absorption costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

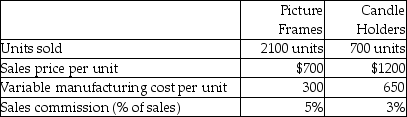

Periphery,Inc.has two products-picture frames and candle holders.Financial data for both the products follow:

Periphery has two sales representatives-Andrew Novak and Liu Wei.Each sales representative sold a total of 1400 units during the month of March.Andrew had a sales mix of 70% picture frames and 30% candle holders.Liu had a sales mix of 80% picture frames and 20% candle holders.What is the contribution margin ratio for picture frames and candle holders,respectively?

Periphery has two sales representatives-Andrew Novak and Liu Wei.Each sales representative sold a total of 1400 units during the month of March.Andrew had a sales mix of 70% picture frames and 30% candle holders.Liu had a sales mix of 80% picture frames and 20% candle holders.What is the contribution margin ratio for picture frames and candle holders,respectively?

A) 57%;46%

B) 52%;43%

C) 5%;3%

D) 43%;54%

Correct Answer

verified

Correct Answer

verified

True/False

For every unit that is produced but not sold,absorption costing "hides" some of the fixed manufacturing overhead in ending Finished Goods Inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

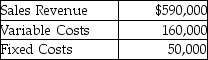

Windspring Spas,Inc.reports the following information for August:

Calculate the contribution margin for August.

Calculate the contribution margin for August.

A) $110,000

B) $430,000

C) $380,000

D) $540,000

Correct Answer

verified

Correct Answer

verified

True/False

In absorption costing,the manufacturing costs expensed are greater than the amount expensed in variable costing when units produced are less than sold because the units in beginning inventory under absorption costing were assigned a greater cost in the previous accounting period.

Correct Answer

verified

Correct Answer

verified

True/False

When there are no units in the beginning Finished Goods Inventory and the units produced are more than the units sold,the operating income will be higher under variable costing than absorption costing.

Correct Answer

verified

Correct Answer

verified

True/False

To explain why two business segments have different contribution margin ratios,take the total amounts and expand them into their two components-units and amount per unit-by dividing the totals by the number of units.

Correct Answer

verified

Correct Answer

verified

True/False

When there are no units in the beginning Finished Goods Inventory and the units produced are more than the units sold,the operating income will be higher under absorption costing than variable costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yancey,Inc.reports the following information:

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent. )

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent. )

A) $59.29

B) $69.29

C) $120.00

D) $99.29

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 148

Related Exams