Correct Answer

verified

Correct Answer

verified

Multiple Choice

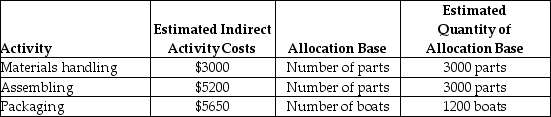

Skipper Company manufactures toy boats and uses an activity-based costing system.The following information is provided for the month of May:

Each boat consists of four parts,and the direct materials cost per boat is $7.21.There is no direct labor.What is the total manufacturing cost per boat? (Round any intermediate calculations and your final answer to the nearest cent. )

Each boat consists of four parts,and the direct materials cost per boat is $7.21.There is no direct labor.What is the total manufacturing cost per boat? (Round any intermediate calculations and your final answer to the nearest cent. )

A) $15.63

B) $22.84

C) $4.43

D) $18.13

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based management is not suitable for service companies as it deals with the proper allocation of manufacturing overhead costs.

Correct Answer

verified

Correct Answer

verified

True/False

The predetermined overhead allocation rate is an estimated overhead cost per unit of the allocation base and is calculated at the beginning of the accounting period.

Correct Answer

verified

Correct Answer

verified

True/False

Just-in-time costing systems use three inventory accounts: Raw Materials Inventory,Work-in-Process Inventory and Finished Goods Inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are the result of producing poor-quality products except ________.

A) decreased costs

B) decreased revenues

C) customer awareness of quality problems

D) increased product repairs

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing refines the cost allocation process even more than traditional allocation costing systems.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following triggers manufacturing under the just-in-time management system?

A) increased purchases

B) consumer demand

C) government pressure

D) budgeted profit

Correct Answer

verified

Correct Answer

verified

True/False

Businesses should invest up front in internal and external failure costs to reduce prevention and appraisal costs.

Correct Answer

verified

Correct Answer

verified

True/False

Direct material costs and direct labor costs cannot be easily traced to products.Therefore,they are allocated to products.

Correct Answer

verified

Correct Answer

verified

True/False

The just-in-time management system results in an increase in the costs to buy,store,insure,and move inventory.

Correct Answer

verified

Correct Answer

verified

True/False

Companies which use a just-in-time management system do not benefit from a quality management system.

Correct Answer

verified

Correct Answer

verified

Essay

Camilleri,Inc.completed the production of 500 units with standard costs of $520 for direct materials and $75 for conversion costs.During the current year,it incurred $260,000 for direct materials and $44,000 for conversion costs.The company uses a just-in-time costing system.Record the adjusting entry for the amount of underallocated or overallocated conversion costs.Omit explanation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

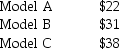

Aviatrix Avionics makes three types of radios for small aircraft-Model A,Model B,and Model C.The manufacturing operations are mechanized,and there is no direct labor.Manufacturing overhead costs are significant,and Aviatrix has adopted an activity-based costing system.Direct materials costs per unit for each model are as follows:

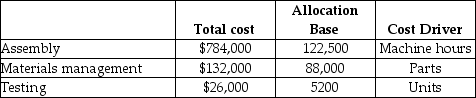

Aviatrix has three activities-assembly,materials management,and testing.The cost driver for assembly is machine hours.The cost driver for materials management is the number of parts,and the cost driver for testing is the number of units of product.Total costs and production volumes for the year were estimated as follows:

Aviatrix has three activities-assembly,materials management,and testing.The cost driver for assembly is machine hours.The cost driver for materials management is the number of parts,and the cost driver for testing is the number of units of product.Total costs and production volumes for the year were estimated as follows:

The Model A radio requires 12 parts to construct and 20 machine hours of processing.What is the manufacturing cost to make one unit of Model A? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

The Model A radio requires 12 parts to construct and 20 machine hours of processing.What is the manufacturing cost to make one unit of Model A? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A) $168

B) $45

C) $151

D) $173

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true of an activity-based costing system?

A) It uses separate predetermined overhead allocation rates for each activity.

B) It is not as accurate or precise as traditional costing systems.

C) It accumulates overhead costs by processing departments.

D) It is not as complex or as costly as traditional systems.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A furniture manufacturer has decided that its use of a single plantwide predetermined overhead allocation rate is no longer accurate.In making the transition to using multiple predetermined overhead allocation rates,which of the following statements is incorrect?

A) With multiple overhead rates,there are multiple cost pools.

B) Management must analyze the expected overhead costs and separate them into a cost pool for each department.

C) With multiple overhead rates,there is one cost pool and multiple allocation bases.

D) The use of multiple predetermined overhead allocation rates is more complex,but it may be more accurate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about quality management systems?

A) Quality management systems only use financial measures to assess success or failure.

B) External failure costs are the easiest quality costs to measure.

C) Businesses should invest upfront in prevention and appraisal costs.

D) Prevention,appraisal and internal costs are not considered in the cost of products.

Correct Answer

verified

Correct Answer

verified

True/False

The main difference between activity-based costing and traditional costing systems is that activity-based costing uses a separate allocation base for each activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following activities to its most appropriate allocation base. -Inspecting finished products.

A) Square footage for each department

B) Number of new employees

C) Number of machine hours

D) Number of batches

E) Number of inspections

F) Number of purchase orders

G) Number of service calls

Correct Answer

verified

Correct Answer

verified

True/False

In the first step in developing an activity-based costing system for a manufacturing company,the management team must determine the activities that incur the majority of the product and period costs.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 189

Related Exams