A) Percentage analysis involves computing the percentage relationship between two amounts.

B) A horizontal analysis of cost of goods sold on the income statement includes dividing net income by total revenue.

C) Horizontal analysis attempts to eliminate the materiality problem of comparing firms of different sizes.

D) In horizontal percentage analysis,a financial statement line item is expressed as a percentage of the previous balance of the same item.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial statement analysis involves forms of comparison including:

A) Comparing changes in the same item over a number of periods.

B) Comparing key relationships within the same year.

C) Comparing key items to industry averages.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

True/False

A limitation of financial statement analysis stems from the discretion of management to choose accounting procedures that cast the best light on the firm's performance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the return on equity (ROE) measure is not true?

A) ROE is used to measure the profitability of the firm in relation to the amount invested by stockholders.

B) ROE equals net income divided by average total stockholders' equity.

C) ROE is affected by a company's use of leverage.

D) A company's ROE is lower than its return on investment because ROE does not consider that part of the business that is financed by debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a potential limitation of financial statement analysis?

A) Lack of comparability of firms in different industries

B) The impact of changing economic conditions

C) The impact of having more than one acceptable alternative accounting principle for accounting for a given transaction or economic event

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios attempt to assess the company's ability to generate earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in Facebook stock and wish to assess the company's position in the stock market.All of the following ratios can be used except:

A) Dividend yield.

B) Earnings per share.

C) Working capital.

D) Price-earnings ratio.

Correct Answer

verified

Correct Answer

verified

True/False

The only requirement involved in communicating useful information is that the information be accurate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson Company declared and paid a cash dividend totaling $500,000 on its common stock.As a result of this transaction,the company's debt to assets ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

Correct Answer

verified

Correct Answer

verified

True/False

Jenkins Company's current ratio is higher than the average for its industry,while its quick ratio is below the industry average.One possible interpretation for these results is that Jenkins carries less inventory than most companies in its industry.

Correct Answer

verified

Correct Answer

verified

True/False

A banker may perform a financial ratio analysis to assess a firm's ability to repay debt in a timely manner.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 1,Gant Corporation had a current ratio of 1.29,quick ratio of 1.05,and working capital of $18,000.The company uses a perpetual inventory system and sells merchandise for more than it cost.On January 1,Year 2,Gant recorded cost of goods sold of $4,100.As a result of this transaction,Gant's quick ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accrual accounting requires the use of many estimates,including:

A) Uncollectible accounts expense.

B) Warranty costs.

C) Assets' useful lives.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

True/False

Working capital is current assets minus current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratios measure a company's long-term debt paying ability and its financing structure?

A) Solvency

B) Liquidity

C) Profitability

D) None of these answers is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

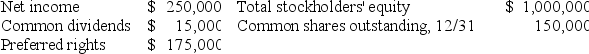

Bernard Company provided the following information from its financial records:

What is the company's book value per share?

What is the company's book value per share?

A) $0.50

B) $5.50

C) $6.67

D) $1.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

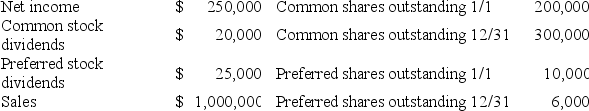

Abel Company provided the following information from its financial records:

What is the amount of the company's earnings per share?

What is the amount of the company's earnings per share?

A) $0.82

B) $1.00

C) $0.90

D) $0.75

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Earnings before interest and taxes divided by interest expense is the formula for which of these analytical measures?

A) Debt to assets ratio

B) Earnings per share

C) Return on investment

D) Number of times interest is earned

Correct Answer

verified

Correct Answer

verified

Multiple Choice

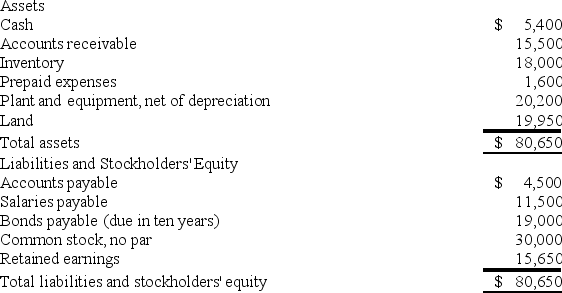

The following balance sheet information is provided for Greene Company for Year 2:

What is the company's quick (acid-test) ratio? (Round your answer to 1 decimal place. )

What is the company's quick (acid-test) ratio? (Round your answer to 1 decimal place. )

A) 0.7

B) 1.4

C) 1.3

D) 3.8

Correct Answer

verified

Correct Answer

verified

Multiple Choice

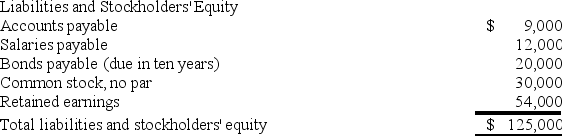

The following partial balance sheet is provided for Groom Company:

What is the company's debt to assets ratio? (Rounded to nearest whole percent. )

What is the company's debt to assets ratio? (Rounded to nearest whole percent. )

A) 49%

B) 16%

C) 33%

D) Cannot be determined with the information given.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 108

Related Exams