A) $681.50

B) $2,914.00

C) $3,595.50

D) $7,191.00

E) Zero, since the employee's pay exceeds the FICA limit

Correct Answer

verified

Correct Answer

verified

Short Answer

A _____________________ shows the pay period dates, hours worked, gross pay, deductions and net pay of each employee for every pay period.

Correct Answer

verified

Correct Answer

verified

True/False

Payroll is usually paid with a check or with the use of an electronic funds transfer.

Correct Answer

verified

Correct Answer

verified

True/False

When the times interest earned ratio declines, the likelihood of default on liabilities increases.

Correct Answer

verified

Correct Answer

verified

True/False

A liability is a probable future payment of assets or services that a company is currently obligated to make as a result of past transactions or events.

Correct Answer

verified

Correct Answer

verified

True/False

Federal depository banks are authorized to accept deposits of amounts payable to the federal government.

Correct Answer

verified

Correct Answer

verified

True/False

Times interest earned can be calculated by multiplying income by the interest rate on a company's debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities:

A) Must be certain

B) Must sometimes be estimated

C) Must be for a specific amount

D) Must always have a definite date for payment

E) Must involve an outflow of cash

Correct Answer

verified

Correct Answer

verified

True/False

Current liabilities are obligations not due within one year or the company's operating cycle, whichever is longer.

Correct Answer

verified

Correct Answer

verified

True/False

A payroll register is a cumulative record of an employee's hours worked, gross earnings, deductions and net pay.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The employer should record payroll deductions as:

A) Employee receivables

B) Payroll taxes

C) Current liabilities

D) Wages payable

E) Employee payables

Correct Answer

verified

Correct Answer

verified

True/False

When the number of withholding allowances increases, the amount of income tax withheld increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A special bank account used solely for the purpose of paying employees, is created by depositing the amount of each employees' net pay into the account every pay period. This account is referred to as a(n) :

A) Federal depository bank account

B) Employee's Individual Earnings account

C) Employees' bank account

D) Payroll register account

E) Payroll bank account

Correct Answer

verified

Correct Answer

verified

Essay

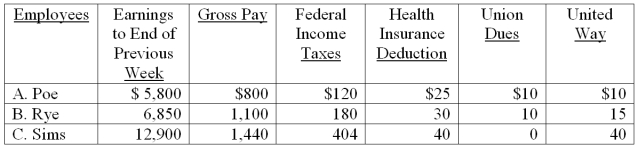

The payroll records of a company provided the following data for the currently weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 10, 2010, Printfast Company sells a commercial printer for $2,350 with a one year warranty that covers parts. Warranty expense is project to be 4% of sales. On February 28, 2011, the printer requires repairs. The cost of the parts for the repair is $80 and Printfast pays their technician $150 to perform the repair. What is the warranty liability at the end of 2010?

A) $49.00

B) $84.80

C) $94.00

D) $0, there is no liability at the end of 2010

E) $230.00

Correct Answer

verified

Correct Answer

verified

True/False

A short-term note payable is a written promise to pay a specified amount on a definite future date within one year or the operating cycle, whichever is longer.

Correct Answer

verified

Correct Answer

verified

True/False

FUTA requires employers to pay a federal unemployment tax on the first $7,000 in salary or wages paid to each employee.

Correct Answer

verified

Correct Answer

verified

Short Answer

Coke had income before interest expense and income taxes of $5,698 million and interest expense of $199 million. Calculate Coke's times interest earned ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The annual Federal Unemployment Tax Return is:

A) Form 940

B) Form 1099

C) Form 104

D) Form W-2

E) Form W-4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Wage and Tax Statement is:

A) Form 940

B) Form 941

C) Form 1040

D) Form W-2

E) Form W-4

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 184

Related Exams