A) sensitive; sensitive; effective

B) responsive; insensitive; ineffective

C) responsive; insensitive; effective

D) not responsive; sensitive; effective

E) not responsive; insensitive; effective

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an economy in which velocity is constant and the same level of real output is produced year after year,a slow increase in the money supply would result in a

A) constant price level

B) slowly increasing price level

C) rapidly increasing price level

D) slowly increasing real GDP

E) rapidly increasing real GDP

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The demand for money varies

A) directly with both the price level and the level of real GDP

B) inversely with both the price level and the level of real GDP

C) inversely with the price level and directly with the level of real GDP

D) directly with the price level and inversely with the level of real GDP

E) inversely with the level of nominal GDP

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of an expansionary monetary policy?

A) Government purchases of goods and services decline.

B) The discount rate is increased.

C) The Fed sells U.S.government securities in the open market.

D) The required reserve ratio is lowered.

E) The income tax is lowered.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the equation of exchange,if the amount of money in the economy of Monetania times the velocity of money equals 800 million Monetanian dollars ($) ,then Monetania's

A) real GDP equals $800 million

B) nominal GDP equals $800 million

C) real GDP equals $800 million times the price level

D) nominal GDP equals $800 million times the price level

E) price level equals 8 Monetanian dollars

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed buys bonds,then the money supply

A) increases,the interest rate falls,and the quantity of money demanded increases

B) falls,the interest rate falls,and the quantity of money demanded increases

C) increases,the interest rate increases,and the quantity of money demanded increases

D) falls,the interest rate increases,and the quantity of money demanded falls

E) falls,the interest rate falls,and the quantity of money demanded falls

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The steeper the short-run aggregate supply curve,the __________ the change in price level and the __________ the change in real Gross Domestic Product for a given shift in the aggregate demand curve.

A) larger; larger

B) larger; smaller

C) smaller; larger

D) smaller; smaller

E) real GDP and the price level are not affected by the shape of the aggregate supply curve

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an economy in which real output grows at an average rate of 3 percent per year,a 7 percent average rate of growth in the money supply would result in a(n)

A) inflation rate of 4 percent,if velocity were constant

B) inflation rate of -4 percent,if velocity were constant

C) $4 increase in the price level per year

D) $4 decrease in the price level per year

E) change in the velocity of money

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the demand and supply of money are initially in equilibrium,and that the demand for money increases.A monetary authority interested in keeping the money supply constant and the interest rate low must

A) increase the money supply

B) decrease the money supply

C) increase the demand for money

D) decrease the demand for money

E) give up pursuing both goals at the same time and choose one or the other

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the aggregate demand-aggregate supply model,an increase in the money supply will cause in the short run a(n)

A) increase in both the price level and real GDP

B) decrease in both the price level and real GDP

C) increase in real GDP and a decrease in the price level

D) decrease in real GDP and an increase in the price level

E) increase in the price level only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To eliminate a contractionary gap,the Fed can __________ the money supply,which would __________.

A) increase; increase the interest rate and investment

B) increase; decrease the interest rate and increase investment

C) decrease; increase the interest rate and investment

D) decrease; decrease the interest rate and investment

E) decrease; increase the interest rate and decrease investment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the interest rate will

A) have no effect on investment,since investment is autonomous

B) increase investment,since it will be more profitable to hold stocks and bonds

C) increase investment,since people will be less willing to hold money

D) decrease investment only if firms have to borrow money to make investments

E) decrease investment regardless of whether firms have to borrow money to make an investment

Correct Answer

verified

Correct Answer

verified

True/False

When the money supply increases,people get rid of their excess money by buying real assets,such as durable goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For interest rates to remain stable during economic expansions,the growth rate of the money supply should

A) exceed the growth in the demand for money

B) just match the growth in the demand for money

C) be less than the growth in the demand for money

D) be zero

E) just match the growth in nominal GDP

Correct Answer

verified

Correct Answer

verified

Multiple Choice

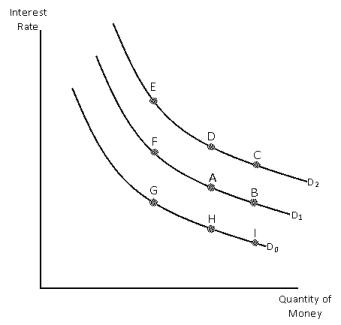

Exhibit 15-7  -Referring to Exhibit 15-7,a decrease in the interest rate will cause a move from

-Referring to Exhibit 15-7,a decrease in the interest rate will cause a move from

A) A to B

B) A to F

C) A to G

D) A to C

E) A to I

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the effect of an expansionary monetary policy on the demand for investment curve?

A) It causes the curve to shift left.

B) It causes the curve to shift right.

C) It causes downward movement along the curve.

D) It causes an upward movement along the curve.

E) It has no effect on the quantity of investment demanded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the reasons that the FOMC lowered its target for the federal funds rate in September 2007 was

A) confidence that the fallout from rising mortgage default rates would not spread to the wider economy

B) the belief that lenders would respond to the housing crisis by loosening lending standards

C) more easily available credit boosting investment and economic growth

D) to add liquidity to financial markets and strengthen the economy

E) All of the answers are correct

Correct Answer

verified

Correct Answer

verified

True/False

When people exchange money for financial assets,the interest rate rises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

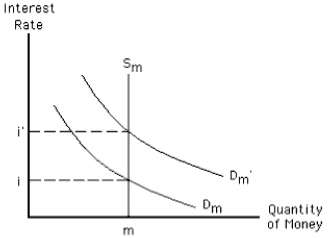

Exhibit 15-6  -If the Fed is targeting the money supply and the money demand shifts from Dm to Dm' in Exhibit 15-6,the Fed will

-If the Fed is targeting the money supply and the money demand shifts from Dm to Dm' in Exhibit 15-6,the Fed will

A) do nothing and the interest rate will rise to i'

B) do nothing and the interest rate will settle at i

C) decrease the money supply to restore its target of i

D) increase the money supply to restore its target of i

E) decrease money demand back to Dm to restore its target of i

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price level rises,then the

A) money supply will increase

B) money supply will decrease

C) quantity of money supplied will increase

D) quantity of money supplied will decrease

E) demand for money will increase

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 198

Related Exams