Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fashion,Inc.had a Retained Earnings balance of $12,000 at December 31,2015.The company had an average income of $7,500 over the next 3 years,and an ending Retained Earnings balance of $15,000 at December 31,2016.What was the total amount of dividends paid over the last three years?

A) $4,500.

B) $6,500.

C) $19,500.

D) $27,000.

Correct Answer

verified

Correct Answer

verified

Essay

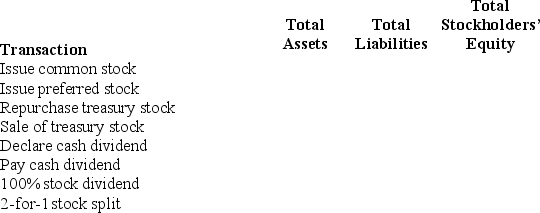

Indicate whether each of the following transactions increases (+),decreases (−),or has no effect (NE)on total assets,total liabilities,and total stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Essay

Court Casuals has the following beginning balances in its stockholders' equity accounts on January 1,2015: Common Stock,$100,000;Additional Paid-in Capital,$4,100,000;and Retained Earnings,$3,000,000.Net income for the year ended December 31,2015,is $800,000.Court Casuals has the following transactions affecting stockholders' equity in 2015:

May 18 Issues 25,000 additional shares of $1 par value common stock for $40 per share.

May 31 Repurchases 5,000 shares of treasury stock for $45 per share.

July 1 Declares a cash dividend of $1 per share to all stockholders of record on July 15.Hint: Dividends are not paid on treasury stock.

July 31 Pays the cash dividend declared on July 1.

August 10 Reissues 2,500 shares of treasury stock purchased on May 31 for $48 per share.

Taking into consideration all the entries described above,prepare the statement of stockholders' equity for the year ended December 31,2015,using the format provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Retained Earnings balance reported on the balance sheet typically is not affected by:

A) Net income.

B) Net loss.

C) Dividends paid.

D) Stock splits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial information for Accessories Unlimited includes the following selected data: What is the company's price-earnings ratio?

A) 20.0.

B) 40.0.

C) 60.0.

D) 80.0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Large stock dividends and stock splits are issued primarily to:

A) Lower the trading price of the stock per share.

B) Increase the number of authorized shares.

C) Increase legal capital.

D) Increase the number of outstanding shares.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On February 22,Brett Corporation reacquired 200 shares of its $5 par value common stock for $25 each.On March 15,the company reissued 70 shares for $30 each.What is true of the entry for reissuing their shares?

A) Credit Cash $1,750.

B) Credit Additional Paid in Capital $350.

C) Debit Treasury Stock $1,750.

D) Credit Treasury Stock $2,100.

Correct Answer

verified

Correct Answer

verified

True/False

Par value is the legal capital per share of stock that's assigned when the corporation is first established.

Correct Answer

verified

Correct Answer

verified

Short Answer

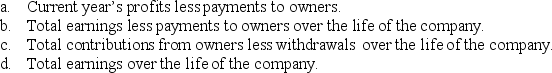

The balance of Retained Earning at the end of the year represents:

Correct Answer

verified

Correct Answer

verified

True/False

An S Corporation allows a company to enjoy limited liability as a corporation,but tax treatment as a partnership.

Correct Answer

verified

Correct Answer

verified

True/False

Par value has a direct relationship to the market value of the common stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is not reported in the stockholders' equity section of the balance sheet?

A) Treasury Stock.

B) Common Stock.

C) Sales Revenue.

D) Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Journal entries to record cash dividends are made on the:

A) Declaration date,record date,and payment date.

B) Record date and payment date.

C) Delaration date and payment date.

D) Delaration date and record date.

Correct Answer

verified

Correct Answer

verified

True/False

We record treasury stock at the cost of the shares reacquired.

Correct Answer

verified

Correct Answer

verified

True/False

Paid-in Capital is the amount stockholders have invested in the company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock:

A) Is always recorded as a liability.

B) Is always recorded as part of stockholders' equity.

C) Can have features of both liabilities and stockholders' equity.

D) Is not included in either liabilities or stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Both cash dividends and stock dividends:

A) Reduce total assets.

B) Reduce total liabilities.

C) Reduce total stockholders' equity.

D) Reduce retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When treasury stock is purchased,what is the effect on assets and stockholders' equity?

A) Assets and stockholders' equity increase.

B) Assets and stockholders' equity decrease.

C) Assets increase and stockholders' equity decrease.

D) Assets decrease and stockholders' equity increase.

Correct Answer

verified

Correct Answer

verified

True/False

The amount of retained earnings equals net income minus dividends for the current year.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 139

Related Exams