A) debit of $1,350 to Manufacturing Overhead.

B) credit of $4,761 to Manufacturing Overhead.

C) credit of $1,350 to Manufacturing Overhead.

D) debit of $4,761 to Manufacturing Overhead.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

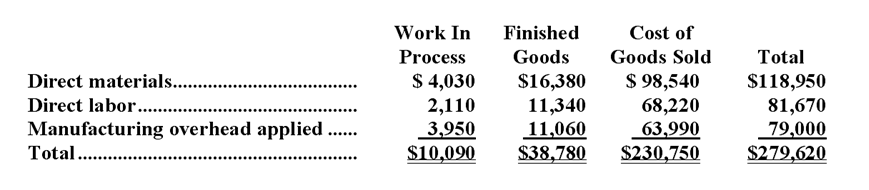

Staniszewski Inc. has provided the following data for the month of March. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was overapplied by $1,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The cost of goods sold for March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was overapplied by $1,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The cost of goods sold for March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

A) $229,940

B) $231,560

C) $231,750

D) $229,750

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debit to the Manufacturing Overhead account in this entry represents indirect labor costs. -The manufacturing overhead applied is:

A) $28,000

B) $29,000

C) $30,000

D) $38,000

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Pinnini Co.uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs.Last year,Pinnini Company incurred $225,000 in actual manufacturing overhead cost.The Manufacturing Overhead account showed that overhead was overapplied $14,500 for the year.If the predetermined overhead rate was $5.00 per direct labor-hour,how many hours did the company work during the year?

A) 45,000 hours

B) 47,900 hours

C) 42,100 hours

D) 44,000 hours

Correct Answer

verified

Correct Answer

verified

Multiple Choice

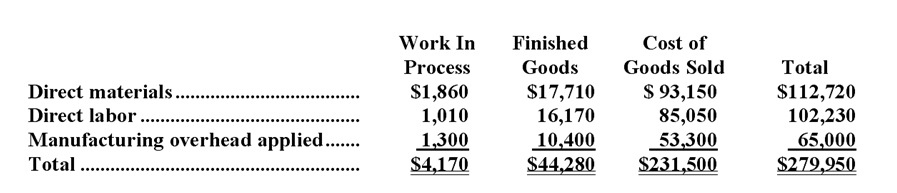

Gressett Inc. has provided the following data for the month of April. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $6,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The work in process inventory at the end of April after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was overapplied by $6,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The work in process inventory at the end of April after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

A) $4,050

B) $4,081

C) $4,259

D) $4,290

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debit to the Manufacturing Overhead account in this entry represents indirect labor costs. -The cost of goods sold (after adjustment for underapplied or overapplied manufacturing overhead) is:

A) $61,000

B) $62,000

C) $63,000

D) $64,000

Correct Answer

verified

Correct Answer

verified

True/False

Underapplied or overapplied manufacturing overhead represents the difference between actual overhead costs and applied overhead costs.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

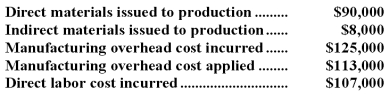

Under Lamprey Company's job-order costing system,manufacturing overhead is applied to Work in Process inventory using a predetermined overhead rate.During January,Lamprey's transactions included the following:  Lamprey Company had no beginning or ending inventories.What was the cost of goods manufactured for January?

Lamprey Company had no beginning or ending inventories.What was the cost of goods manufactured for January?

A) $302,000

B) $310,000

C) $322,000

D) $330,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kirson Corporation incurred $89,000 of actual Manufacturing Overhead costs during December.During the same period,the Manufacturing Overhead applied to Work in Process was $92,000.The journal entry to record the application of Manufacturing Overhead to Work in Process would include a:

A) debit to Manufacturing Overhead of $92,000

B) debit to Work in Process of $89,000

C) credit to Manufacturing Overhead of $92,000

D) credit to Work in Process of $89,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a job-order costing system,indirect materials that have been previously purchased and that are used in production are recorded as a debit to:

A) Work in Process inventory.

B) Manufacturing Overhead.

C) Finished Goods inventory.

D) Raw Materials inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During July at Tiner Corporation,$74,000 of raw materials were requisitioned from the storeroom for use in production.These raw materials included both direct and indirect materials.The indirect materials totaled $7,000.The journal entry to record this requisition would include a debit to Manufacturing Overhead of:

A) $0

B) $74,000

C) $7,000

D) $67,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wedd Corporation had $35,000 of raw materials on hand on May 1.During the month,the company purchased an additional $68,000 of raw materials.During May,$92,000 of raw materials were requisitioned from the storeroom for use in production.These raw materials included both direct and indirect materials.The indirect materials totaled $5,000.The debits to the Work in Process account as a consequence of the raw materials transactions in May total:

A) $92,000

B) $0

C) $68,000

D) $87,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Snappy Company has a job-order costing system and uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. Manufacturing overhead cost and direct labor hours were estimated at $100,000 and 40,000 hours, respectively, for the year. In July, Job #334 was completed at a cost of $5,000 in direct materials and $2,400 in direct labor. The labor rate is $6 per hour. By the end of the year, Snappy had worked a total of 45,000 direct labor-hours and had incurred $110,250 actual manufacturing overhead cost. -If Job #334 contained 200 units,the unit product cost on the completed job cost sheet would be:

A) $37.00

B) $42.00

C) $41.90

D) $39.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martinez Aerospace Company uses a job-order costing system.The direct materials for Job #045391 were purchased in July and put into production in August.The job was not completed by the end of August.At the end of August,in what account would the direct material cost assigned to Job #045391 be located?

A) Raw materials inventory

B) Work in process inventory

C) Finished goods inventory

D) Cost of goods manufactured

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sharp Company's records show that overhead was overapplied by $10,000 last year.This overapplied manufacturing overhead was closed out to the Cost of Goods Sold account at the end of the year.In trying to determine why overhead was overapplied by such a large amount,the company has discovered that $6,000 of depreciation on factory equipment was charged to administrative expense in error.Given the above information,which of the following statements is true?

A) Manufacturing overhead was actually overapplied by $16,000 for the year.

B) The company's net income is understated by $6,000 for the year.

C) Under the circumstances posed above,the error in recording depreciation would have no effect on net operating income for the year.

D) The $6,000 in depreciation should have been charged to Work in Process rather than to administrative expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carter Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $135,850. Actual manufacturing overhead for the year amounted to $145,000 and actual machine-hours were 5,660. The company's predetermined overhead rate for the year was $24.70 per machine-hour. -The applied manufacturing overhead for the year was closest to:

A) $135,850

B) $149,218

C) $143,869

D) $139,802

Correct Answer

verified

Correct Answer

verified

True/False

Advertising costs should be charged to the Manufacturing Overhead account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

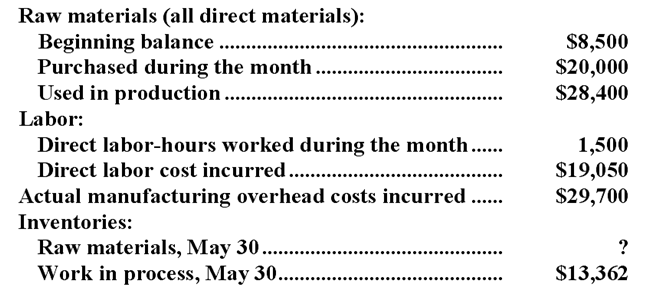

Daane Company had only one job in process on May 1. The job had been charged with $1,000 of direct materials, $3,302 of direct labor, and $5,382 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $20.70 per direct labor-hour.

During May, the following activity was recorded:

Work in process inventory on May 30 contains $2,921 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The amount of direct materials cost in the May 30 work in process inventory account was:

Work in process inventory on May 30 contains $2,921 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The amount of direct materials cost in the May 30 work in process inventory account was:

A) $5,680

B) $19,900

C) $8,400

D) $11,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

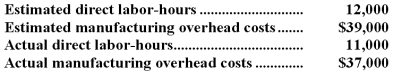

Washtenaw Corporation uses a job-order costing system.The following data are for last year:  Washtenaw applies overhead using a predetermined rate based on direct labor-hours.What predetermined overhead rate was used last year?

Washtenaw applies overhead using a predetermined rate based on direct labor-hours.What predetermined overhead rate was used last year?

A) $3.55 per direct labor-hour

B) $3.25 per direct labor-hour

C) $3.08 per direct labor-hour

D) $3.36 per direct labor-hour

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The actual manufacturing overhead incurred at Hogans Corporation during April was $59,000,while the manufacturing overhead applied to Work in Process was $74,000.The company's Cost of Goods Sold was $289,000 prior to closing out its Manufacturing Overhead account.The company closes out its Manufacturing Overhead account to Cost of Goods Sold.Which of the following statements is true?

A) Manufacturing overhead was overapplied by $15,000;Cost of Goods Sold after closing out the Manufacturing Overhead account is $274,000

B) Manufacturing overhead was underapplied by $15,000;Cost of Goods Sold after closing out the Manufacturing Overhead account is $274,000

C) Manufacturing overhead was overapplied by $15,000;Cost of Goods Sold after closing out the Manufacturing Overhead account is $304,000

D) Manufacturing overhead was underapplied by $15,000;Cost of Goods Sold after closing out the Manufacturing Overhead account is $304,000

Correct Answer

verified

A

Correct Answer

verified

Showing 1 - 20 of 154

Related Exams