A) the CPI.

B) the PPI.

C) the GDP deflator.

D) real interest rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is 6 percent and the rate of inflation is 10 percent, then the real interest rate is

A) -16 percent.

B) -4 percent.

C) 4 percent.

D) 16 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following changes in the price index produces the greatest rate of inflation: 100 to 110, 150 to 165, or 180 to 198?

A) 100 to 110

B) 150 to 165

C) 180 to 198

D) All of these changes produce the same rate of inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that over the past year, the real interest rate was 6 percent and the inflation rate was -2 percent. It follows that

A) the dollar value of savings increased at 4 percent, and the purchasing power of savings increased at 6 percent.

B) the dollar value of savings increased at 4 percent, and the purchasing power of savings increased at 8 percent.

C) the dollar value of savings increased at 8 percent, and the purchasing power of savings increased at 4 percent.

D) the dollar value of savings increased at 8 percent, and the purchasing power of savings increased at 6 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

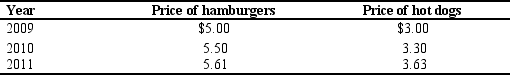

Table 6-6. The table below applies to an economy with only two goods - hamburgers and hot dogs. The fixed basket consists of 4 hamburgers and 8 hot dogs.

-Refer to Table 6-6. If the base year is 2010, then the economy's inflation rate in 2010 is

-Refer to Table 6-6. If the base year is 2010, then the economy's inflation rate in 2010 is

A) 8 percent.

B) 10 percent.

C) 10.91 percent.

D) 11.11 percent.

Correct Answer

verified

Correct Answer

verified

True/False

The CPI does not reflect the increase in the value of the dollar that arises from the introduction of new goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the typical consumer buys more bananas than oranges. In fixing the basket of goods and services for the purpose of calculating the consumer price index, the Bureau of Labor Statistics

A) ignores the fact that the typical consumer buys more bananas than orange; this procedure does not affect the value of the index.

B) ignores the fact that the typical consumer buys more bananas than orange; this procedure results in a potentially-serious bias in the index.

C) places more weight on the price of bananas than on the price of oranges; the weights of the two prices are determined by surveying consumers.

D) places more weight on the price of bananas than on the price of oranges; the weights of the two prices are determined by the extent to which those prices have changed over the previous year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CPI is calculated

A) weekly.

B) monthly.

C) quarterly.

D) yearly.

Correct Answer

verified

Correct Answer

verified

True/False

When the price of nuclear missiles rises, this change is reflected in the CPI but not in the GDP deflator.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The consumer price index tries to gauge how much incomes must rise to maintain

A) an increasing standard of living.

B) a constant standard of living.

C) a decreasing standard of living.

D) the highest standard of living possible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price index was 90 in year 1, 100 in year 2, and 95 in year 3, then the economy experienced

A) 10 percent inflation between years 1 and 2 ,and 5 percent inflation between years 2 and 3.

B) 10 percent inflation between years 1 and 2, and 5 percent deflation between years 2 and 3.

C) 11.1 percent inflation between years 1 and 2, and 5 percent inflation between years 2 and 3.

D) 11.1 percent inflation between years 1 and 2, and 5 percent deflation between years 2 and 3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

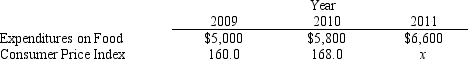

Table 6-12. Will's expenditures on food for three consecutive years, along with other values, are presented in the table below.

-Refer to Table 6-12. Will's 2009 food expenditures in 2010 dollars amount to

-Refer to Table 6-12. Will's 2009 food expenditures in 2010 dollars amount to

A) $5,500.

B) $5,250.

C) $4,975.

D) $3,625.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 6-4 Quinn has job offers in Wrexington and across the country in Charlieville. The Wrexington job would pay a salary of $50,000 per year, and the Charlieville job would pay a salary of $40,000 per year. The CPI in Wrexington is 150, and the CPI in Charlieville is 90. -Refer to Scenario 6-4. The Charlieville salary in Wrexington dollars is

A) $24,000.00.

B) $26,666.67.

C) $60,000.00

D) $66,666.67.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the quality of beef changes over time, but the quality change goes unmeasured for the purpose of computing the consumer price index. In which of the following instances would the bias resulting from the unmeasured quality change be least severe?

A) The quality of beef deteriorates and beef becomes more expensive relative to other goods.

B) The quality of beef deteriorates and beef becomes less expensive relative to other goods.

C) The quality of beef improves and beef becomes more expensive relative to other goods.

D) The quality of beef improves and the price of beef relative to other prices remains unchanged.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 6-3 Sue Holloway was an accountant in 1944 and earned $12,000 that year. Her son, Josh Holloway, is an accountant today and he earned $210,000 in 2008. The price index was 17.6 in 1944 and 184 in 2008. -Refer to Scenario 6-3. In real terms, Josh Holloway's income amounts to about what percentage of Sue Holloway's income?

A) 67 percent

B) 167 percent

C) 1045 percent

D) 1750 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is the most accurate statement about the GDP deflator and the consumer price index?

A) The GDP deflator compares the price of a fixed basket of goods and services to the price of the basket in the base year, whereas the consumer price index compares the price of currently produced goods and services to the price of the same goods and services in the base year.

B) The consumer price index compares the price of a fixed basket of goods and services to the price of the basket in the base year, whereas the GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base year.

C) Both the GDP deflator and the consumer price index compare the price of a fixed basket of goods and services to the price of the basket in the base year.

D) Both the GDP deflator and the consumer price index compare the price of currently produced goods and services to the price of the same goods and services in the base year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following pairs of values of the consumer price index (CPI) is consistent with an inflation rate of 14 percent for 2011?

A) CPI in 2011 = 150; CPI in 2012 = 164

B) CPI in 2011 = 150; CPI in 2012 = 171

C) CPI in 2010 = 150; CPI in 2011 = 164

D) CPI in 2010 = 150; CPI in 2011 = 171

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The CPI can be used to compare dollar figures from different points in time.

B) The percentage change in the CPI is a measure of the inflation rate, but the percentage change in the GDP deflator is not a measure of the inflation rate.

C) Compared to the consumer price index (CPI) , the GDP deflator is the more common gauge of inflation.

D) The GDP deflator better reflects the goods and services bought by consumers than does the CPI.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corey deposits $1,000 in a savings account that pays an annual interest rate of 5 percent. Over the course of a year, the inflation rate is 1.7 percent. At the end of the year, Corey has

A) $17 more in his account, and his purchasing power has increased by $10.

B) $30 more in his account, and his purchasing power has increased by $50.

C) $40 more in his account, and his purchasing power has increased by $33.

D) $50 more in his account, and his purchasing power has increased by $33.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If 2004 is the base year, then the inflation rate for 2005 equals

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 420

Related Exams