A) Accumulated Depreciation - Equipment.

B) Prepaid Rent.

C) Unearned Consulting Revenue.

D) Accounts Payable.

E) Depreciation Expense - Equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If in preparing a work sheet an adjusted trial balance amount is mistakenly sorted to the wrong work sheet column. The Balance Sheet columns will balance on completing the work sheet but with the wrong net income, if the amount sorted in error is:

A) An expense amount placed in the Balance Sheet Credit column.

B) A revenue amount placed in the Balance Sheet Debit column.

C) A liability amount placed in the Income Statement Credit column.

D) An asset amount placed in the Balance Sheet Credit column.

E) A liability amount placed in the Balance Sheet Debit column.

Correct Answer

verified

Correct Answer

verified

Not Answered

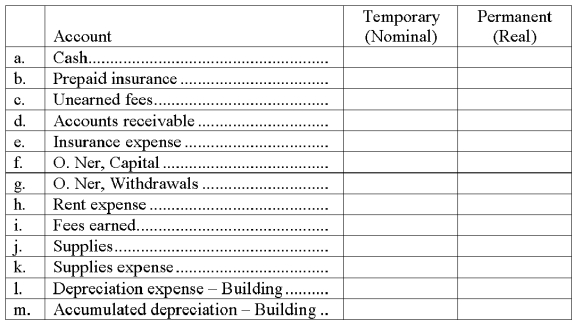

In the table below, indicate with an "X" in the proper column whether the account is a temporary (nominal) account or a permanent (real) account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A classified balance sheet:

A) Measures a company's ability to pay its bills on time.

B) Organizes assets and liabilities into important subgroups.

C) Presents revenues, expenses, and net income.

D) Reports operating, investing, and financing activities.

E) Reports the effect of profit and withdrawals on owner's capital.

Correct Answer

verified

Correct Answer

verified

True/False

Closing entries are normally entered in the general journal and then posted to the work sheet.

Correct Answer

verified

Correct Answer

verified

True/False

Reversing entries are optional.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is incorrect?

A) Permanent accounts is another name for nominal accounts.

B) Temporary accounts carry a zero balance at the beginning of each accounting period.

C) The Income Summary account is a temporary account.

D) Real accounts remain open as long as the asset, liability, or equity items recorded in the accounts continue in existence.

E) The closing process applies only to temporary accounts.

Correct Answer

verified

Correct Answer

verified

True/False

If all columns balance upon completion of a work sheet, you can be sure that no errors were made in preparing the work sheet.

Correct Answer

verified

Correct Answer

verified

True/False

A company has current assets of $15,000 and current liabilities of $9,500. Its current ratio is 1.6. $15,000/$9,500 = 1.6

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Another name for temporary accounts is:

A) Real accounts.

B) Contra accounts.

C) Accrued accounts.

D) Balance column accounts.

E) Nominal accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had revenues of $187,000 and expenses of $109,000 for the accounting period. The owner withdrew $37,000 during the year. Which of the following entries could not be a closing entry?

A) Debit Income Summary $78,000; credit Owner's, Capital $78,000.

B) Debit Capital $37,000; credit Withdrawals $37,000.

C) Debit Revenues $187,000; credit Income Summary $187,000.

D) Debit Income Summary $109,000, credit Expenses $109,000.

E) Debit Income Summary $187,000; credit Revenues $187,000.

Correct Answer

verified

Correct Answer

verified

Short Answer

A ____________________ helps in preparing financial statements, is useful in preparing interim statements, and is helpful in showing the effects of proposed transactions.

Correct Answer

verified

Correct Answer

verified

Not Answered

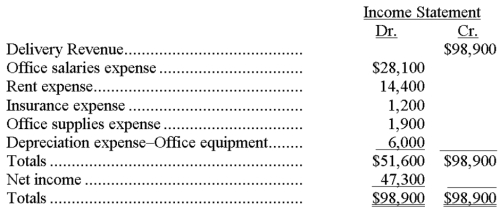

The items that follow appeared in the Income Statement columns of the work sheet prepared for Armstrong Delivery Service at current year-end. In addition, L. Armstrong, Capital had a credit balance of $117,000 and L. Armstrong, Withdrawals had a debit balance of $30,000 at year end. Prepare closing journal entries for this company.

Correct Answer

verified

Correct Answer

verified

True/False

A post-closing trial balance is a list of permanent accounts and their balances from the ledger after all closing entries are journalized and posted.

Correct Answer

verified

Correct Answer

verified

Short Answer

Balance sheet accounts are called ____________________ accounts because they carry their balances to the next accounting period, and are not closed as long as the company continues to own the asset, owe the liability and have equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements regarding the Income Statement columns on the worksheet are true except:

A) The balances in the Income Statement credit column are revenues.

B) The balances in the Income Statement credit column are unearned revenues.

C) The balances in the Income Statement debit column are expenses.

D) The difference between the totals of the Income Statement columns is net income or net loss.

E) The net income or net loss from the Income Statement columns is entered in the Balance Sheet & Statement of Owner's Equity columns.

Correct Answer

verified

Correct Answer

verified

True/False

An expense account is normally closed by debiting Income Summary and crediting the expense account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Owner's capital must be closed each accounting period.

B) A post-closing trial balance should include only permanent accounts.

C) Information on the work sheet can be used in place of preparing financial statements.

D) By using a work sheet to prepare adjusting entries you need not post these entries to the ledger accounts.

E) Closing entries are only necessary if errors have been made.

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets are long-term resources that benefit business operations that usually lack physical form and have uncertain benefits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about a company's operating cycle is not true?

A) Noncurrent items are those expected to come due within one year or the company's operating cycle.

B) The operating cycle is the time span from when cash is used to acquire goods and services until cash is received from the sale of goods and services.

C) The length of a company's operating depends on its activities.

D) For a merchandiser selling products, the operating cycle is the time span between paying suppliers for merchandise and receiving cash from customers.

E) Most operating cycles are less than one year.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 176

Related Exams