Correct Answer

verified

Correct Answer

verified

True/False

If a firm utilizes debt financing,a 10% decline in earnings before interest and taxes (EBIT)will result in a decline in earnings per share that is larger than 10%,and the higher the debt ratio,the larger this difference will be.

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,an increase in financial leverage will increase a firm's market (or systematic)risk as measured by its beta coefficient.

Correct Answer

verified

Correct Answer

verified

True/False

The trade-off theory states that capital structure decisions involve a tradeoff between the costs and benefits of debt financing.

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed that bankruptcy did not exist.That led to the development of the "trade-off" model,where the firm's value first rises with the use of debt due to the tax shelter of debt,but later falls as more debt is added because the potential costs of bankruptcy begin to more than offset the tax shelter benefits.Under the trade-off theory,an optimal capital structure exists.

Correct Answer

verified

Correct Answer

verified

True/False

As the text indicates,a firm's financial risk can and should be divided into separate market and diversifiable risk components.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? As a firm increases the operating leverage used to produce a given quantity of output,this

A) normally leads to an increase in its fixed assets turnover ratio.

B) normally leads to a decrease in its business risk.

C) normally leads to a decrease in the standard deviation of its expected EBIT.

D) normally leads to a decrease in the variability of its expected EPS.

E) normally leads to a reduction in its fixed assets turnover ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The capital structure that maximizes the stock price is also the capital structure that minimizes the cost of equity from retained earnings (rS) .

B) The capital structure that maximizes the stock price is also the capital structure that maximizes earnings per share.

C) The capital structure that maximizes the stock price is also the capital structure that maximizes the firm's times interest earned (TIE) ratio.

D) If a company increases its debt ratio,this will typically increase the marginal costs of both debt and equity,but it still may reduce the company's WACC.

E) If Congress were to pass legislation that increases the personal tax rate but decreases the corporate tax rate,this would encourage companies to increase their debt ratios.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

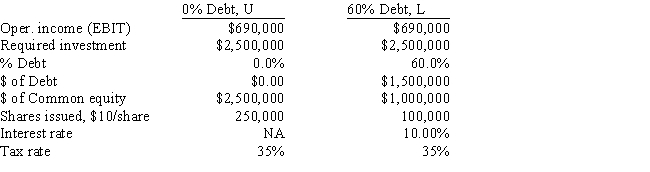

You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $600,000.Other data for the firm are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e. ,what is EPSL - EPSU?

A) $1.29

B) $1.97

C) $2.23

D) $1.72

E) $1.63

Correct Answer

verified

D

Correct Answer

verified

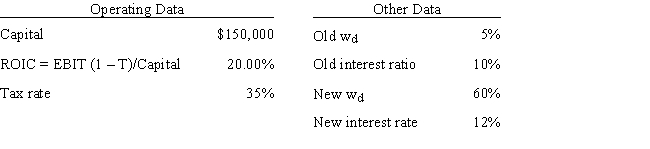

Multiple Choice

Your firm's debt ratio is only 5.00%,but the new CFO thinks that more debt should be employed.She wants to sell bonds and use the proceeds to buy back and retire common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Other things held constant,and based on the data below,if the firm increases the percentage of debt in its capital structure (wd) to 60.0%,by how much would the ROE change,i.e. ,what is ROENew - ROEOld? Do not round your intermediate calculations.

A) 14.95%

B) 19.17%

C) 17.59%

D) 21.64%

E) 14.42%

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same total assets,total investor-supplied capital,operating income (EBIT) ,tax rate,and business risk.Company HD,however,has a much higher debt ratio than LD.Also,both companies' returns on investors' capital (ROIC) exceed their after-tax costs of debt,rd(1 - T) .Which of the following statements is CORRECT?

A) HD should have a higher return on assets (ROA) than LD.

B) HD should have a higher times interest earned (TIE) ratio than LD.

C) HD should have a higher return on equity (ROE) than LD,but its risk,as measured by the standard deviation of ROE,should also be higher than LD's.

D) Given that ROIC > rd(1 - T) ,HD's stock price must exceed that of LD.

E) Given that ROIC > rd(1 - T) ,LD's stock price must exceed that of HD.

Correct Answer

verified

Correct Answer

verified

True/False

According to Modigliani and Miller (MM),in a world without taxes the optimal capital structure for a firm is approximately 100% debt financing.

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed,among other things,that outside stockholders have the same information about a firm's future prospects as its managers.That was called "symmetric information," and it is questionable.The introduction of "asymmetric information" led to the development of the "signaling" theory of capital structure,which postulated that firms are reluctant to issue new stock because investors will interpret such an act as a signal that the firm's managers are worried about its future.Other actions give off different signals,and the end result is that capital structure is affected by managers' perceptions about how their financing decisions will affect investors' views of the firm and thus its value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In general,a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

B) There is no reason to think that changes in the personal tax rate would affect firms' capital structure decisions.

C) A firm with a relatively high business risk is more likely to increase its use of financial leverage than a firm with low business risk,assuming all else equal.

D) If a firm's after-tax cost of equity exceeds its after-tax cost of debt,it can always reduce its WACC by increasing its use of debt.

E) Suppose a firm has less than its optimal amount of debt.Increasing its use of debt to the point where it is at its optimal capital structure will decrease the costs of both debt and equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Generally,debt ratios do not vary much among different industries,although they do vary among firms within a given industry.

B) Electric utilities generally have very high common equity ratios because their revenues are more volatile than those of firms in most other industries.

C) Airline companies tend to have very volatile earnings,and as a result they generally have high target debt-to-equity ratios.

D) Wide variations in capital structures exist both between industries and among individual firms within given industries.These differences are caused by differing business risks and also managerial attitudes.

E) Since most stocks sell at or very close to their book values,book value capital structures are typically adequate for use in estimating firms' weighted average costs of capital.

Correct Answer

verified

Correct Answer

verified

True/False

A firm's business risk is largely determined by the financial characteristics of its industry,especially by the amount of debt the average firm in the industry uses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information below,what is the firm's optimal capital structure?

A) Debt = 40%;Equity = 60%;EPS = $2.95;Stock price = $26.50.

B) Debt = 50%;Equity = 50%;EPS = $3.05;Stock price = $28.90.

C) Debt = 60%;Equity = 40%;EPS = $3.18;Stock price = $31.20.

D) Debt = 80%;Equity = 20%;EPS = $3.42;Stock price = $30.40.

E) Debt = 70%;Equity = 30%;EPS = $3.31;Stock price = $30.00.

Correct Answer

verified

C

Correct Answer

verified

True/False

The Miller model begins with the Modigliani and Miller (MM)model with corporate taxes and then adds personal taxes.

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller (MM),in their second article,took account of taxes,bankruptcy,and other factors that were assumed away in their original article.Once they took account of all these assumptions,they concluded that every firm has a unique optimal capital structure.Moreover,a manager can use the second MM model to determine his or her firm's optimal debt ratio.

Correct Answer

verified

Correct Answer

verified

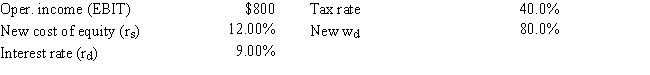

Multiple Choice

As a consultant to First Responder Inc. ,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 80.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 9.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 - T) because no new operating capital is needed,and then divide by (WACC - g) .Do not round your intermediate calculations.

A) $7,143

B) $8,000

C) $7,357

D) $5,357

E) $5,929

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 88

Related Exams