A) The company's net income would increase.

B) The company's earnings per share would decline.

C) The company's cost of equity would increase.

D) The company's ROA would increase.

E) The company's ROE would decline.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

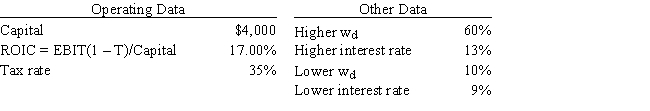

You have been hired by a new firm that is just being started.The CFO wants to finance with 60% debt,but the president thinks it would be better to hold the percentage of debt in the capital structure (wd) to only 10%.Other things held constant,and based on the data below,if the firm uses more debt,by how much would the ROE change,i.e. ,what is ROENew - ROEOld? Do not round your intermediate calculations.

A) 10.31%

B) 11.59%

C) 10.43%

D) 9.15%

E) 10.54%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

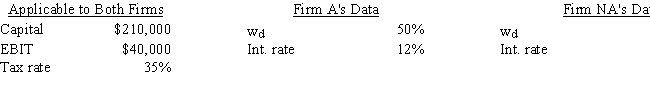

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical--they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e. ,what is ROEA - ROENA? Do not round your intermediate calculations.

A) 4.90%

B) 3.71%

C) 4.58%

D) 5.54%

E) 3.76%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

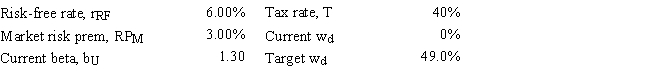

Dye Industries currently uses no debt,but its new CFO is considering changing the capital structure to 49.0% debt (wd) by issuing bonds and using the proceeds to repurchase and retire some common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity,i.e. ,what is rL - rU? Do not round your intermediate calculations.

A) 2.59%

B) 1.91%

C) 2.92%

D) 1.57%

E) 2.25%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

El Capitan Foods has a capital structure of 36% debt and 64% equity,its tax rate is 35%,and its beta (leveraged) is 1.40.Based on the Hamada equation,what would the firm's beta be if it used no debt,i.e. ,what is its unlevered beta,bU?

A) 1.03

B) 1.29

C) 0.80

D) 0.88

E) 1.15

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have identical amounts of assets,investor-supplied capital,operating income (EBIT) ,tax rates,and business risk.Company HD,however,has a higher debt ratio than LD.Company HD's return on investors' capital (ROIC) exceeds its after-tax cost of debt,rd(1 - T) .Which of the following statements is CORRECT?

A) Company HD has a higher return on assets (ROA) than Company LD.

B) Company HD has a higher times interest earned (TIE) ratio than Company LD.

C) Company HD has a higher return on equity (ROE) than Company LD,and its risk as measured by the standard deviation of ROE is also higher than LD's.

D) The two companies have the same ROE.

E) Company HD's ROE would be higher if it had no debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Business risk is affected by a firm's operations.Which of the following is NOT directly associated with (or does not directly contribute to) business risk?

A) Demand variability.

B) Sales price variability.

C) The extent to which operating costs are fixed.

D) The extent to which interest rates on the firm's debt fluctuate.

E) Input price variability.

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller's second article,which assumed the existence of corporate income taxes,led to the conclusion that a firm's value would be maximized,and its cost of capital minimized,if it used (almost)100% debt.However,this model did not take account of bankruptcy costs.The existence of bankruptcy costs leads to the assumption of an optimal capital structure where the debt ratio is less than 100%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) As a rule,the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS.

B) The optimal capital structure simultaneously maximizes EPS and minimizes the WACC.

C) The optimal capital structure minimizes the cost of equity,which is a necessary condition for maximizing the stock price.

D) The optimal capital structure simultaneously minimizes the cost of debt,the cost of equity,and the WACC.

E) The optimal capital structure simultaneously maximizes the stock price and minimizes the WACC.

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller's first article led to the conclusion that capital structure is extremely important,and that every firm has an optimal capital structure that maximizes its value and minimizes its cost of capital.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms U and L each have the same amount of assets,investor-supplied capital,and both have a return on investors' capital (ROIC) of 12%.Firm U is unleveraged,i.e. ,it is 100% equity financed,while Firm L is financed with 50% debt and 50% equity.Firm L's debt has an after-tax cost of 8%.Both firms have positive net income and a 35% tax rate.Which of the following statements is CORRECT?

A) The two companies have the same times interest earned (TIE) ratio.

B) Firm L has a lower ROA than Firm U.

C) Firm L has a lower ROE than Firm U.

D) Firm L has the higher times interest earned (TIE) ratio.

E) Firm L has a higher EBIT than Firm U.

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for Firms A and B to have identical financial and operating leverage,yet for Firm A to have more risk as measured by the variability of EPS.This would occur if Firm A has more business risk than Firm B.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monroe Inc.is an all-equity firm with 500,000 shares outstanding.It has $2,000,000 of EBIT,and EBIT is expected to remain constant in the future.The company pays out all of its earnings,so earnings per share (EPS) equal dividends per share (DPS) ,and its tax rate is 40%.The company is considering issuing $4,500,000 of 9.00% bonds and using the proceeds to repurchase stock.The risk-free rate is 4.5%,the market risk premium is 5.0%,and the firm's beta is currently 1.10.However,the CFO believes the beta would rise to 1.30 if the recapitalization occurs.Assuming the shares could be repurchased at the price that existed prior to the recapitalization,what would the price per share be following the recapitalization? (Hint: P0 = EPS/rs because EPS = DPS. )

A) $34.52

B) $27.84

C) $21.44

D) $28.12

E) $29.51

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's target capital structure should do which of the following?

A) Maximize the earnings per share (EPS) .

B) Minimize the cost of debt (rd) .

C) Obtain the highest possible bond rating.

D) Minimize the cost of equity (rs) .

E) Minimize the weighted average cost of capital (WACC) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have identical tax rates,total assets,total investor-supplied capital,and returns on investors' capital (ROIC) ,and their ROICs exceed their after-tax costs of debt,rd(1 - T) .However,Company HD has a higher debt ratio and thus more interest expense than Company LD.Which of the following statements is CORRECT?

A) Company HD has a higher net income than Company LD.

B) Company HD has a lower ROA than Company LD.

C) Company HD has a lower ROE than Company LD.

D) The two companies have the same ROA.

E) The two companies have the same ROE.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would tend to increase a firm's target debt ratio,other things held constant?

A) The costs associated with filing for bankruptcy increase.

B) The corporate tax rate is increased.

C) The personal tax rate is increased.

D) The Federal Reserve tightens interest rates in an effort to fight inflation.

E) The company's stock price hits a new low.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southwest U's campus book store sells course packs for $19 each.The variable cost per pack is $12,and at current annual sales of 43,000 packs,the store earns $75,000 before taxes on course packs.How much are the fixed costs of producing the course packs?

A) $203,400

B) $277,980

C) $253,120

D) $226,000

E) $221,480

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the debt ratio will generally have no effect on which of these items?

A) Business risk.

B) Total risk.

C) Financial risk.

D) Market risk.

E) The firm's beta.

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,firms that use assets that can be sold easily (like trucks)tend to use more debt than firms whose assets are harder to sell (like those engaged in research and development).

Correct Answer

verified

Correct Answer

verified

True/False

Different borrowers have different risks of bankruptcy,and if a borrower goes bankrupt,its lenders will probably not get back the full amount of funds that they loaned.Therefore,lenders charge higher rates to borrowers judged to be more likely to go bankrupt.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams